TAX INFORMATION

No Tax Increase for Homeowners Age 65 & OLDER

Under state law, as long as a homestead and over 65 exemption application have been filed with the local appraisal district, the dollar amount of school taxes imposed on the residence homestead of a person 65 years of age or older cannot be increased above the amount paid in the first year after the person turned 65 – regardless of changes in tax rate or property value – unless significant improvements are made to the home, increasing the overall value.

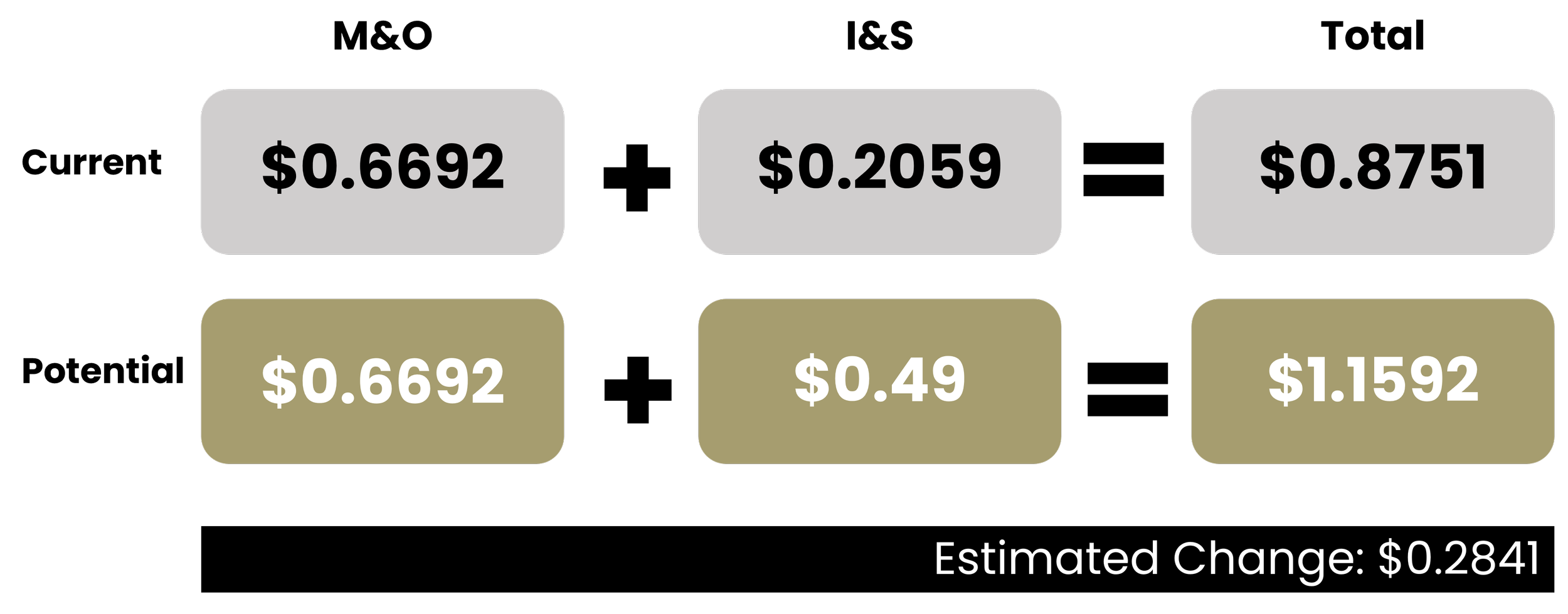

UNDERSTANDING THE TAX RATE

A school district's total tax rate is made up of two parts, which divide the school district budget into two “buckets” - the maintenance and operations (M&O) rate and the interest and sinking (I&S) rate. Each has a designated purpose and budget.

M&O Tax Rate vs. I&S Tax Rate

The M&O budget is used for daily operations of the district, including utilities, salaries, supplies, repairs, and fuel.

The I&S budget is used to repay debt for capital improvements through voter-approved bonds. These improvements include new construction, renovations, HVAC and roofing replacements, land purchase, furniture, and technology.

Bond elections only affect the I&S tax rate. Funds from a bond CANNOT be used as part of the M&O budget or to increase salaries.

HOW DOES THE BOND IMPACT TAXES?

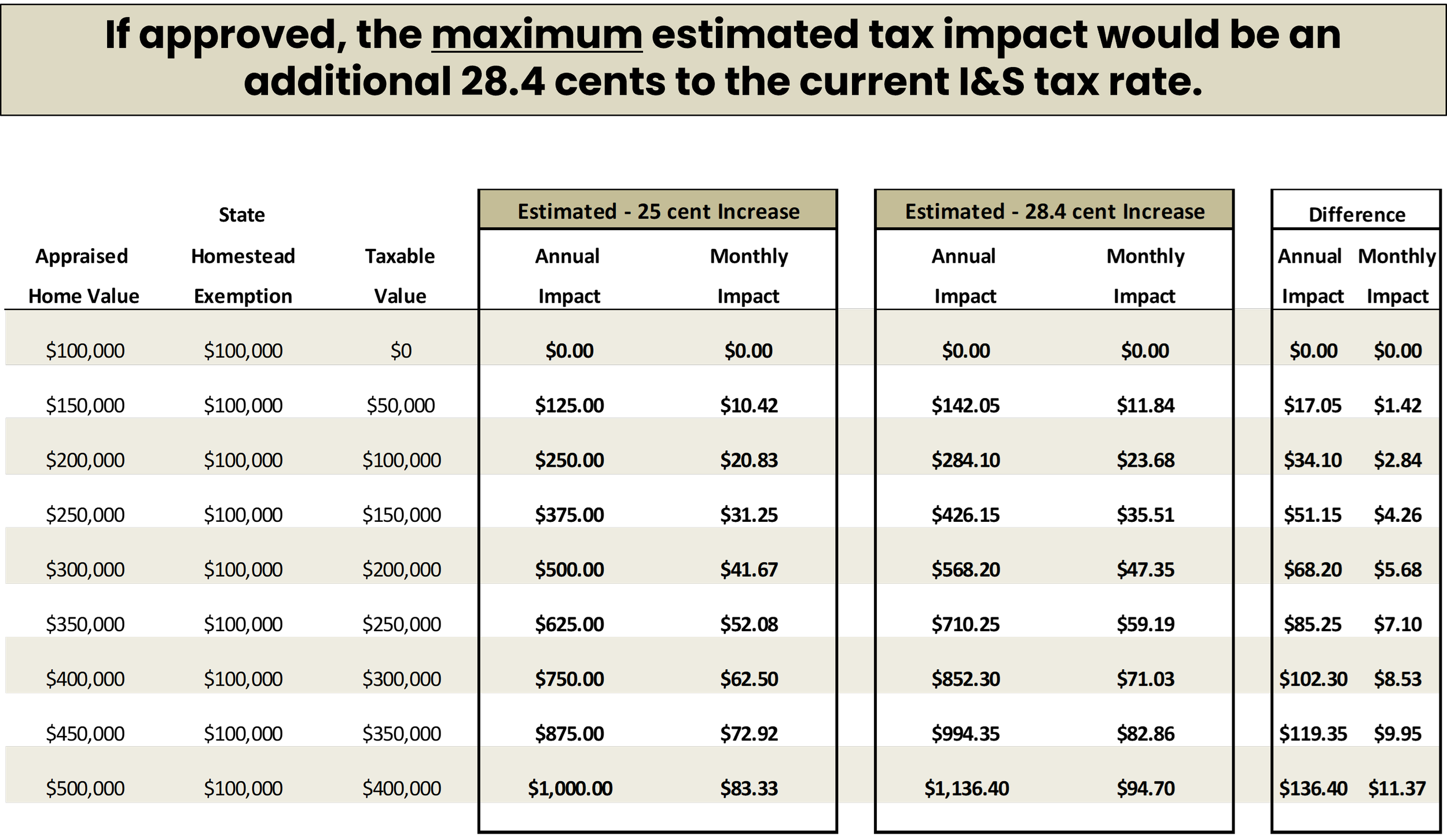

If approved, the maximum estimated tax impact would be an additional 28.4 cents to the current McGregor ISD I&S tax rate.

Timing to issue bonds: A bond election is not an actual assurance of immediate debt. It is an authorization for the Board to issue bonds at some point in the future as financial capacity becomes available. Overall, it is the District's intent to issue bonds in phases taking into account property values, bond interest rates and project timing, while maintaining the I&S tax rate below the maximum 49 cent estimate.